By Todd Swinderman on Jan 15, 2021 2:45:00 PM

In part 1, I focused on how safety, cleanliness, and productivity are all linked together when justifying conveyor improvements. So, you should now understand that it is often financially beneficial to make conveyor improvements. For a refresher or to get up to speed on that, click  .

.

Different Approaches To Analyzing Purchases/Projects

Many facilities use different methods when planning a project and purchasing equipment. The purchasing department might only look at price and the lowest bid in order to save cost. The maintenance and engineering departments might consider life-cycle cost. Corporate management might focus on reducing risk and maximizing cash flow.

However, everyone should have an interest in making sure any project or equipment cost can be recouped through savings that can be earned from that investment.

Basic Concepts of Return On Investment (ROI):

To calculate ROI, the benefit of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

Net Present Value

Net Present Value

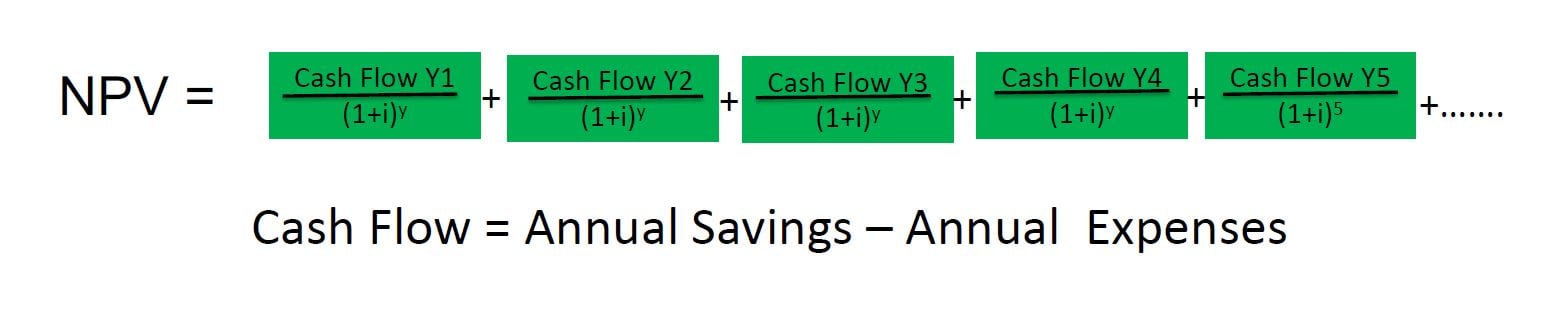

Net Present Value (NPV) is another way of justifying purchases...it is the difference between the present value of cash inflow and the present value of cash outflow over a period of time. Simply stated, it compares the savings over time to investments spent today. Net Present Value is used in capital budgeting to analyze profitability of a projected investment or project. When used in conveyor upgrades, it can give clarity to cost savings that result from less cleanup, less equipment failure, reduced risk of injury, and increased production.

Using NPV allows for varying savings and expenses over time. It considers the cost of money and the value of money over time. Using it helps compare different investment options over time through the lens of today’s dollars.

What you Need to Know to Use NPV Analysis:

- Initial investment

- Company's cost of money (use 10% if unknown)

- Annual expenses such as maintenance and energy

- Annual expected savings

Data to back up ROI is crucial. Be sure to identify opportunities and collect information!

Cost of Money = Cost to the Company From All Funding Sources:

- Bank borrowing

- Dividend payments on stock

- Shareholder loans

- Sale of unused assets

The cost of money is usually significantly more than the prime rate. I wrote an entire chapter on using accounting methods to justify safety investments. I hope it might help you on your ROI journey.

Time Period For Analyzing Investments:

- Safety projects: 5-7 years. It takes time for the culture to change and adapt

- Equipment purchase: Expected life of the equipment

- New facility or mine: Expected life of the facility/mine

Example of NPV

Cash Flow Generated From Investment = NPV — Initial Investment

Conclusion/Takeaways

Remember, cleaner, safer. and more productive are all linked! Company culture can affect how you present your proposal so be sure to avoid DATA-FREE CONVERSATIONS. Simple ROI (savings/cost) doesn't measure cash flow. NPV is the method corporate uses to evaluate projects.

If you want to quickly try some cost analysis on your own, see link below:

I am happy to help anyone with this process or answer any questions. Leave a comment and I will get back with an explanation!

comments